One of the questions I get asked a lot is about the current state of the housing market and it’s outlook. If you go online and start researching this topic, there are all kinds of articles suggesting all kinds of ups and downs based on all kinds of data and interpretations of the data.

One element to consider when looking into the property market is that the property market has traditional seasonal selling seasons and ups and downs throughout the year, so one quarter’s results shouldn’t be taken in isolation.

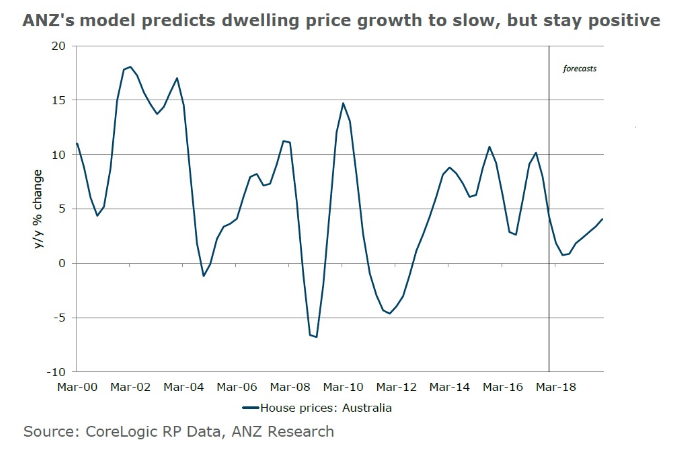

The ANZ bank recently released their outlook for 2018, where they predict 1 percent growth in the second quarter of 2018 and 2 per cent growth for the year as a whole, down from the 4.2 percent growth in 2017.

Their model is more positive for 2019 predicting 4 percent overall growth. Their economic outlook summary suggests they don’t predict a nationwide decline in dwelling prices over the next two years, however individual cities may see annual falls.

There are many economic variables the ANZ has taken into account here, which is why it’s such a difficult task to try and predict the overall Australian property economic outlook. The main risk in their current model is from interest rate movements. If interest rates remain low due to lower than expected wages growth, the ANZ economists suggest they would expect housing prices to rise by more than the current model predicts, due to the interest rate lag.

Steady Prices For 2018

So with parts of Sydney quietening down after a massive price growth period, here at Plan Assist we see a stable economy for the year like the ANZ, rates on hold for 12mths, and business confidence and unemployment continuing at the same pace.

What this means for property is a “slow and steady” year where not much happens, and after five years of sensational growth, a slight pause is very welcoming for the lenders and government policy makers who were itching to slow things down.